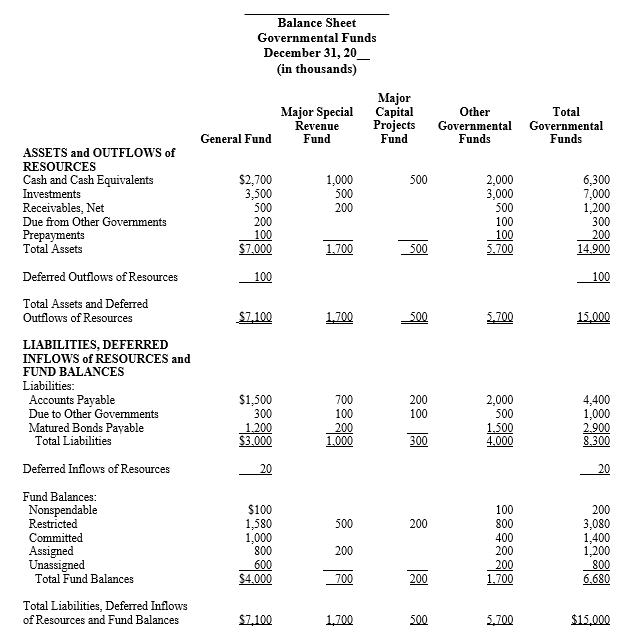

Marvelous Governmental Fund Balance Sheet

It is essential that differences between GAAP fund balance and budgetary fund balance be fully appreciated.

Governmental fund balance sheet. Because of the current financial resources measurement focus of governmental funds fund balance is often considered a measure of. Cash from a bond issuance that must be spent within the school system according to the bond indenture98000. The balance sheet of a non-profit organization is prepared in the same manner as in the case of a business enterprise.

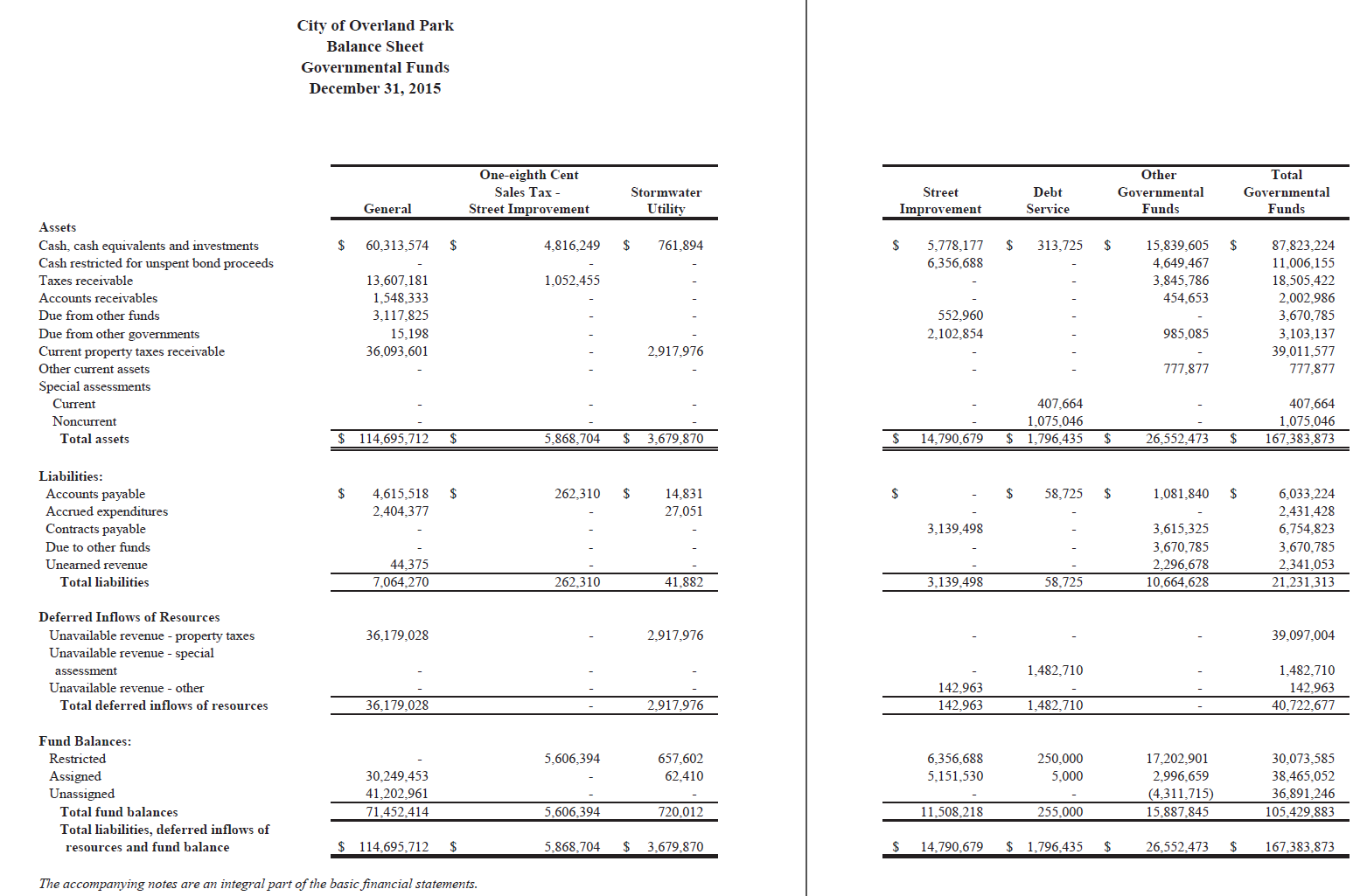

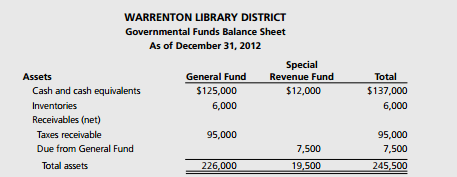

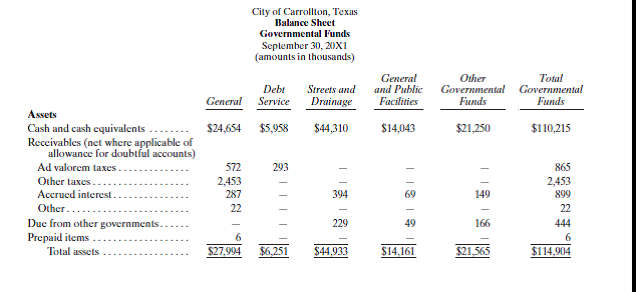

In the governmental funds balance sheet there are no lines specific to lease accounting as the short - term lease is treated as an expenditure for rent while the long - term non - ownership - transferring lease is treated as both an expenditure and an other financing source. On the balance sheet for the governmental fund that made the commitment a portion of the Fund Balance figure is separated to indicate that this amount of current financial resources will be needed in the future to meet the requirements of the commitment. In other words with a few exceptions the governmental funds balance sheet reports cash and other financial resources such as receivables as assets and amounts owed that are expected to be paid off within a short period of time as liabilities.

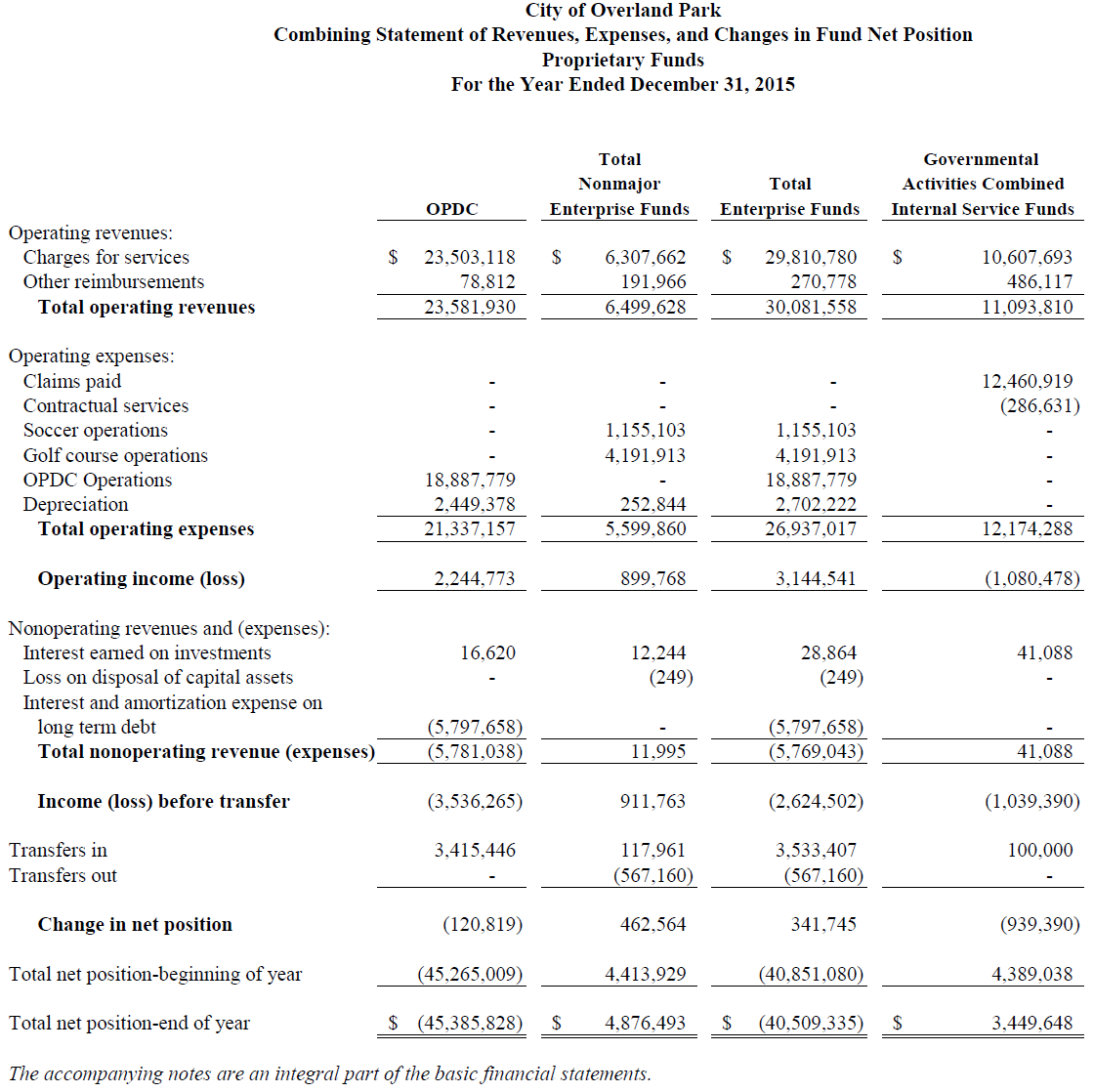

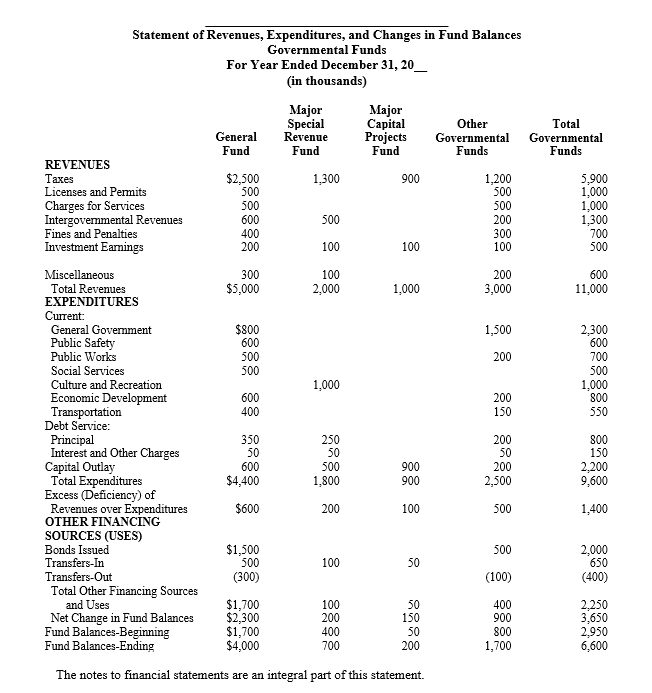

Statement of revenues expenditures and changes in fund balances. Fund balance and net position are the difference between fund assets plus deferred outflows of resources and liabilities plus deferred inflows of resources reflected on the balance sheet or statement of net position. Current assets liabilities and fund balances of governmental funds should be displayed in a balance sheet using the following formula.

The unrestricted fund balance is the portion of that total fund balance that is not restricted in any way and can be spent however the government chooses to. Proprietary and fiduciary fund equity is reported as net position. General capital assets and general long-term liabilities are not reported in the governmental fund balance sheet.

When budgets are established they are compiled at the fund level. RECONCILIATION OF THE GOVERNMENTAL FUNDS BALANCE SHEET TO THE STATEMENT OF NET POSITION June 30 2018 Exhibit B-1a Dollars in Thousands Total fund balances - governmental funds see Exhibit B-1 8757567 Amounts reported for governmental activities in the Statement of Net Position are different because. The Non-profit organizations do not use the term Capital.

Fund balance is reported as nonspendable restricted committed assigned or unassigned. A Total fund balance in the general fund in excess of nonspendable restricted committed and assigned fund balance ie surplus. 1 While in both cases fund balance is intended to serve as a measure of the financial resources available in a governmental fund.

.png)